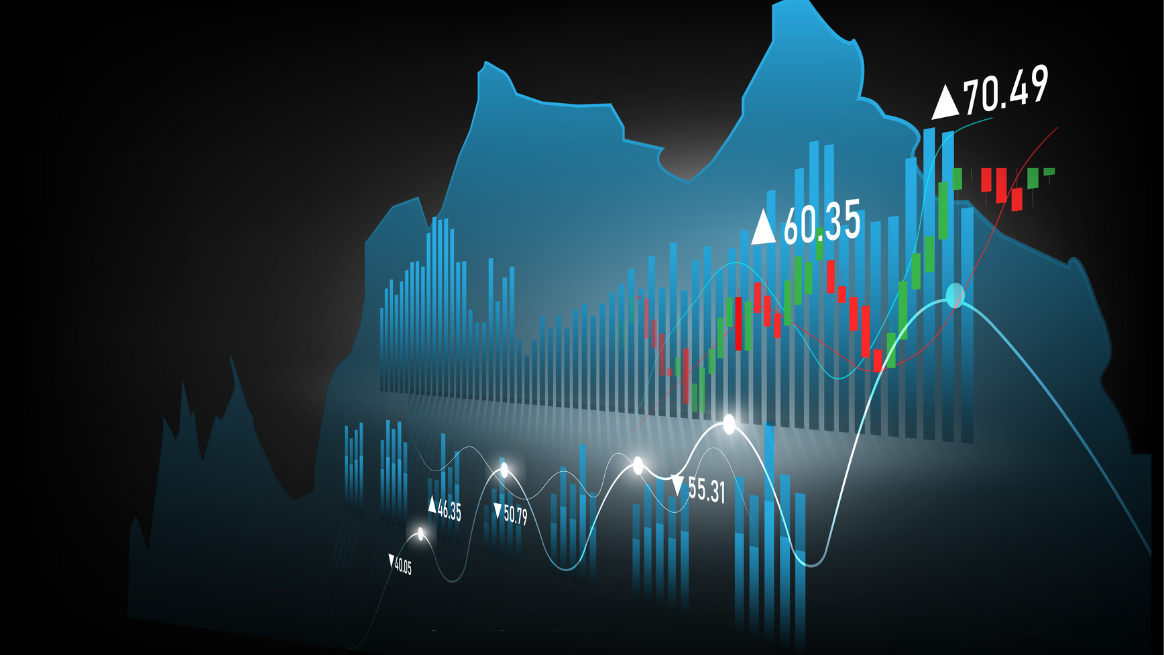

The financial markets might seem like a complicated maze to the uninitiated, but to those in the know, they offer an intricate dance of numbers, trends, and patterns. Among these patterns, one of the most tried-and-true methods for navigating this dance is the trendline trading strategy. So, what exactly is it? How does it work, and more importantly, how can you use it to your advantage? Let’s dive in!

Understanding the Trendline Trading Strategy

The art of investing lies in understanding the ebbs and flows of the market, and one such tool that offers valuable insights into this understanding is the trendline trading strategy. It’s a proven trading approach that has found its footing in the realm of Forex trading and beyond.

Origins of the Trendline Trading Strategy

The origins of the trendline trading strategy are as rich and storied as the financial markets themselves. This method harkens back to the very genesis of technical analysis. Charles Dow, often referred to as the father of modern technical analysis, was among the first to utilize trends in his investment decisions. The technique has since evolved, building on Dow’s principles and adapting to the intricacies of modern markets.

The true beauty of the trendline trading strategy lies in its simplicity, making it accessible to novices and experienced traders alike. Its principles have found application across various markets, including Forex, commodities, and equities, standing as a testament to its adaptability and resilience.

Basics of Drawing Trendlines

Mastering the art of drawing trendlines is akin to learning a new language, one that allows you to communicate effectively with the market. Here’s a more detailed look into the process:

- Identify Pivot Points: The first step to drawing trendlines is to identify pivot points, i.e., the peaks and troughs in the price chart. An upward trendline connects the lows, while a downward trendline connects the highs.

- Use a Line Chart: While you can draw trendlines on any type of chart, a line chart simplifies the process by focusing on closing prices, which are often considered the most important prices of the day.

- Draw the Line: Use a straight line to connect at least two pivot points. The more points that touch the line, the stronger the trendline is considered to be.

- Consider the Angle: Be wary of the angle of the trendline. While steep trendlines can indicate a strong trend, they are often less reliable and may not hold up over time.

Why Trendlines Matter

Trendlines are not just a tool to draw pretty lines on your chart. They’re a critical component of the trendline trading strategy for several reasons:

- Visual Clarity: Trendlines help to clear the clutter and provide a visual representation of the price movement, allowing you to spot the underlying trend.

- Dynamic Support and Resistance: Trendlines act as dynamic support and resistance levels. Prices often bounce off these trendlines, making them valuable for making trading decisions.

- Signal Reversal Points: When a price breaks through a trendline, it’s often a signal of a potential trend reversal. This gives traders a heads-up and allows them to prepare their trading strategy accordingly.

By understanding the origins, the basics of drawing trendlines, and their significance, traders can wield the trendline trading strategy effectively to navigate the tumultuous seas of financial trading.

Applications of the Trendline Trading Strategy

The trendline trading strategy is more than just a technical tool; it’s a key that can unlock a multitude of possibilities in the world of trading. Let’s look at how this strategy can be applied to boost your trading game.

Spotting Market Trends

The adage “the trend is your friend” is a cornerstone of trading philosophy, and for good reason. Following the trend increases the chances of successful trades, and trendlines can help spot these trends. Whether it’s a bull market with rising prices or a bear market with falling prices, trendlines provide clear visuals of the market’s direction.

In an upward trend, the trendline is drawn below the price, effectively serving as a line of support where prices tend to rebound. In a downward trend, the trendline is placed above the price, acting as a line of resistance where prices often bounce back.

Being able to spot these trends enables traders to make informed decisions about when to enter or exit a trade, maximizing their potential for profits while minimizing risk.

Identifying Reversal Points

In the realm of trading, timing is everything. The trendline trading strategy is an excellent tool for identifying potential reversal points, giving traders a headstart in adjusting their trading positions.

When prices break through a trendline, it’s often an early signal of a potential trend reversal. For instance, if prices break through an upward trendline, it may signal the beginning of a downward trend, and vice versa.

However, false breakouts do occur, so it’s crucial to seek further confirmation before deciding to enter or exit a trade. This could come in the form of waiting for a retest of the trendline or looking at other technical indicators for validation.

By spotting market trends and identifying reversal points, the trendline trading strategy provides traders with the necessary insights to navigate the financial markets effectively. Whether you’re a novice trader learning the ropes or a seasoned pro looking to sharpen your strategy, understanding the applications of the trendline trading strategy is a valuable asset in your trading arsenal.

Implementing the Trendline Trading Strategy

Understanding the theory behind the trendline trading strategy is one thing; implementing it is another. This strategy is like a Swiss Army Knife in the world of trading—multifaceted, versatile, and practical. Let’s explore how you can put this strategy into action.

Analyzing the Market

The first step in implementing the trendline trading strategy is understanding the market’s current state. Is the market trending upwards, downwards, or moving sideways? The trendline can provide the answer.

Observing the market and drawing trendlines will help you identify potential trading opportunities. Remember, an upward trendline is drawn under the prices, connecting at least two lows, and a downward trendline is drawn above prices, connecting at least two highs. The steeper the trendline, the less reliable it may be, so be mindful of this as you draw your trendlines.

Setting Stop Losses and Take Profit Levels

Risk management is a critical aspect of trading, and it’s no different with the trendline trading strategy. Once you have identified a potential trading opportunity, it’s crucial to decide on your stop-loss and take-profit levels.

Stop-loss orders should ideally be placed just beyond the trendline. If the price breaks the trendline and hits your stop loss, it might be an indication of a trend reversal. On the other hand, take-profit levels are generally set at points of potential resistance (for downward trendlines) or support (for upward trendlines). These levels represent points at which the price trend could potentially reverse, making them logical points to take profits.

Timing Your Entries

Identifying the right time to enter the market is crucial when using the trendline trading strategy. One method is to look for prices to bounce off the trendline, indicating the trend’s continuation. Another approach is to wait for a trendline break, signaling a potential trend reversal. However, be wary of false breakouts—a price break might not always indicate a genuine trend change.

For example, in an upward trend, a good time to enter a buy position might be when the price rebounds off the trendline. Conversely, in a downward trend, you might consider entering a sell position when the price bounces off the trendline.

By carefully analyzing the market, setting appropriate stop-loss and take-profit levels, and timing your entries correctly, you can implement the trendline trading strategy to optimize your trading performance. Like any trading strategy, it requires practice and fine-tuning, but with time, it can prove to be an invaluable tool in your trading toolkit.

Common Mistakes in Trendline Trading

Even though the trendline trading strategy is an effective tool, it isn’t foolproof. Traders often find themselves falling into certain pitfalls. By identifying and understanding these common mistakes, you can refine your trendline trading and make it a more powerful weapon in your trading arsenal.

Drawing Arbitrary Trendlines

A critical error that traders often make is drawing arbitrary trendlines that don’t accurately reflect the market trend. When the trendline doesn’t touch multiple points of highs or lows, it can misrepresent the trend, leading to incorrect trading decisions.

Remember, the trendline isn’t a decorative feature; it serves a functional purpose. It should connect the right highs and lows to depict the market’s direction accurately. While it may be tempting to force a trendline to fit your desired narrative, this could result in misguided decisions and potential losses. Stick to the principles, and let the trendline reveal the true story of the market.

Ignoring Market Context

It’s easy to become so fixated on the trendline that you forget to take the larger market context into account. While trendlines are a powerful tool, they shouldn’t be used in isolation. Over-reliance on trendlines could lead to biased trading decisions.

Market factors such as volume, price action, and economic indicators should also be considered. For instance, an upward trend with low volume might be less reliable than one with high volume. Similarly, global economic events can influence market trends and should be taken into account.

So while trendlines should be a part of your trading strategy, they shouldn’t be the whole story. Consider the broader market context to make well-rounded trading decisions.

Disregarding False Breakouts

Another common mistake is disregarding the possibility of false breakouts. A price break through the trendline can often signal a potential reversal in the market trend. However, false breakouts—where the price breaks the trendline but quickly reverses back to the previous trend—can occur.

It’s crucial not to rush into a trade solely based on a trendline break. Always seek additional confirmation, like a significant increase in volume or a retest of the trendline, before deciding to enter or exit a trade.

By avoiding these common mistakes in trendline trading, you can increase the effectiveness of your trading strategy and make more informed decisions in the dynamic world of trading. It’s all about discipline, learning from past errors, and continually refining your strategy.

FAQ’s about Trendline Trading Strategy

Now, let’s address some common questions regarding the trendline trading strategy.

1. Is the trendline trading strategy suitable for beginners?

Absolutely! The trendline trading strategy is straightforward and easy to grasp, making it an excellent strategy for beginners. However, like any strategy, it requires practice to perfect.

2. Can the trendline trading strategy be used in all markets?

Yes, the trendline trading strategy can be applied in any market where price trends are observable. This includes Forex, commodities, stocks, and even cryptocurrencies.

3. How reliable is the trendline trading strategy?

The reliability of the trendline trading strategy depends on the trader’s ability to accurately draw trendlines and interpret market trends. While it’s not a magic bullet, it’s a valuable tool when used correctly.

4. What happens when the price breaks the trendline?

A price break through the trendline could signify a potential reversal in the market trend. However, traders should seek additional confirmation before making a trade, as false breakouts can occur.

5. How can I improve my trendline trading?

Improving your trendline trading comes down to practice and education. Regularly analyze market trends, refine your trendline drawing skills, and continue learning about market dynamics and trading strategies.

6. Can I use trendline trading in combination with other strategies?

Absolutely. In fact, many traders use the trendline trading strategy alongside other strategies like price action trading or indicator-based trading for more robust market analysis.

Conclusion

In the dance of numbers, trends, and patterns that is Forex trading, the trendline trading strategy is a reliable partner. Its simplicity and effectiveness have stood the test of time, making it a favorite among traders. Whether you’re a beginner dipping your toes in the market or an experienced trader looking for a solid strategy, the trendline trading strategy could be just the tool you need.

Remember, like any trading strategy, it’s not infallible. Always manage your risk, continue to educate yourself, and never stop refining your strategy. Happy trading!

1 comment on “A Deep Dive Into the Trendline Trading Strategy”